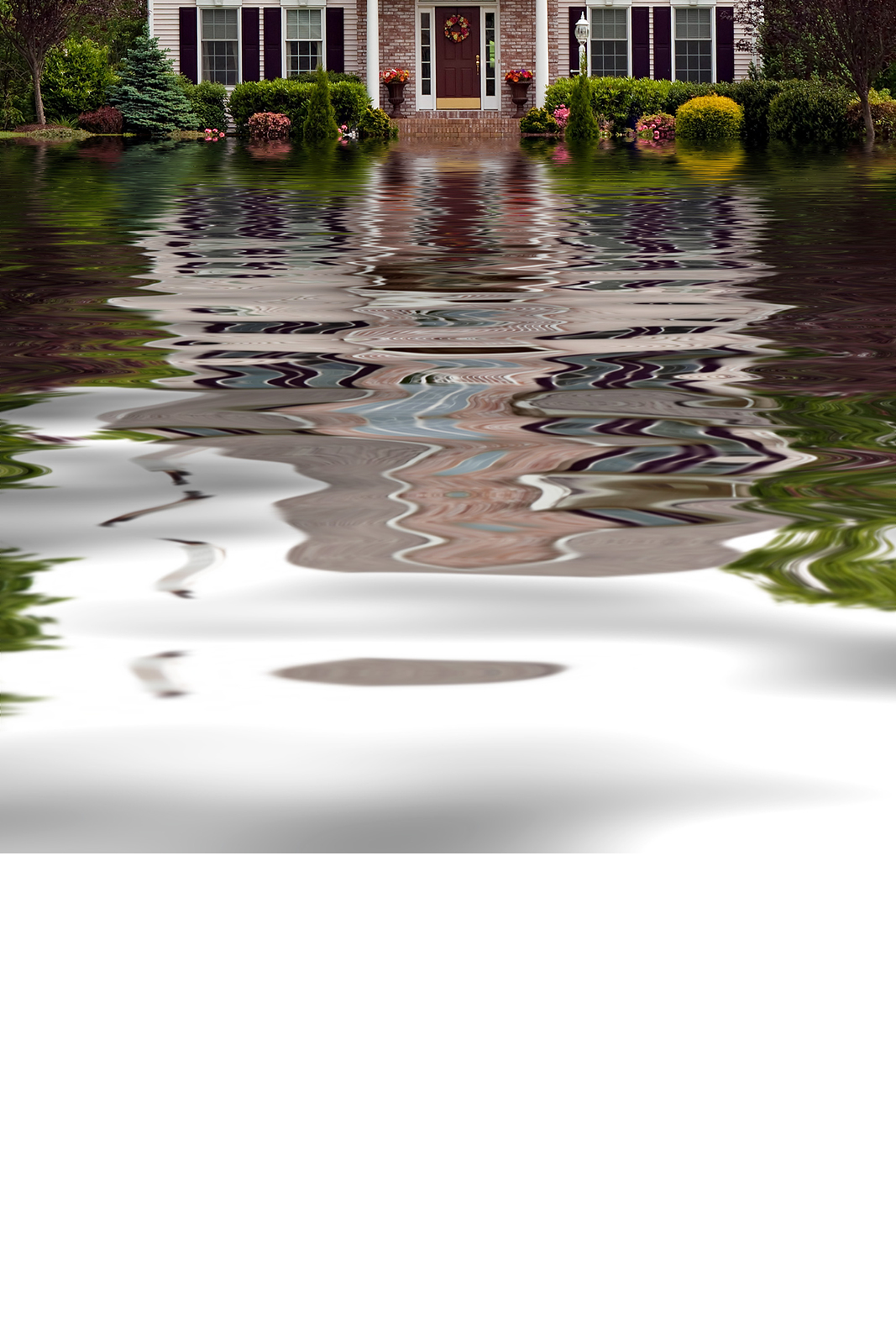

Flood Re launched in April 2016 and will promote the availability and affordability of flood insurance for up to 350,000 homeowners across the UK who are at risk of flooding.

This article explains more about how Flood Re will work as well as providing general advice to homeowners on managing flood risk.

What is Flood Re?

Here in the UK, our standard buildings and contents insurance policies usually cover us against damage from flooding, along with other problems like fire or theft. In recent years, we have had several very serious floods, and this has meant the cost of flood insurance rates has been increasing. Many people who live in places that have flooded, or are very likely to flood in the future, are already struggling to find more affordable home insurance – your household may have experienced this problem already.

Insurance companies and the Government have been working together to develop a different way of dealing with flood insurance. They have decided on a scheme that will:

- Enable flood cover to be more affordable for the households at highest risk of flooding.

- Increase the availability and the choice of insurers for customers.

- Allow time for the Government, local authorities, insurers and communities to become better prepared for flooding.

This scheme will be in operation for the next 25 years, which may sound like a long time, but there is a lot that has to be done during this period. There is more about this later in this article.

How does Flood Re work and what does it mean for you?

Flood Re makes no difference to the way you buy your home insurance. Any claims you need to make will continue to be handled by the insurance company you’ve chosen. As a result of the creation of the Flood Re scheme, you should have greater choice of insurance policies and they should be more competitively priced.

You won’t have to pay anything directly to Flood Re, because your insurance company will be dealing with that for you. All insurance companies contribute to the costs of the scheme, as they pay a special ‘levy’ to Flood Re.

Your insurance company will continue to be responsible for setting the premiums they charge to you, after taking into account all the things they already look at (like the risks of fire, theft, or subsidence).

Why will Flood Re only be in place for 25 years?

Flood Re has another important role to play, as well as helping to enable home insurance to be more widely available and affordable in areas at risk of flooding. Part of the Flood Re scheme means offering help to people to increase their understanding of their level of flood risk and explaining how, where possible, they can take action to reduce that risk. There is more information about this on Flood Re’s own website: www.floodre.co.uk

By the end of the 25 years of Flood Re, we should be able to return to a system for home insurance prices that will be based more accurately on the kind of flood risks each household actually faces. This will work rather like motor insurance does today, where those who run the highest risks of needing to claim on their policies will usually pay more than those who are only at low risk.

While Flood Re is in force, there will be a review at least every five years, to check how much progress has been made on managing this return to pricing flood cover according to risk. These reviews could mean looking again at the premiums charged for each policy, as well as the ‘levy’ charged by Flood Re to UK home insurers.

Follow the link to find or more or to get a quote for our Flood Risk Insurance